Punjab Solar Tenders Now Demand Land First — We’ve Already Solved That

A Ready-to-Deploy Opportunity for Large IPPs, Funds, and EPC Majors

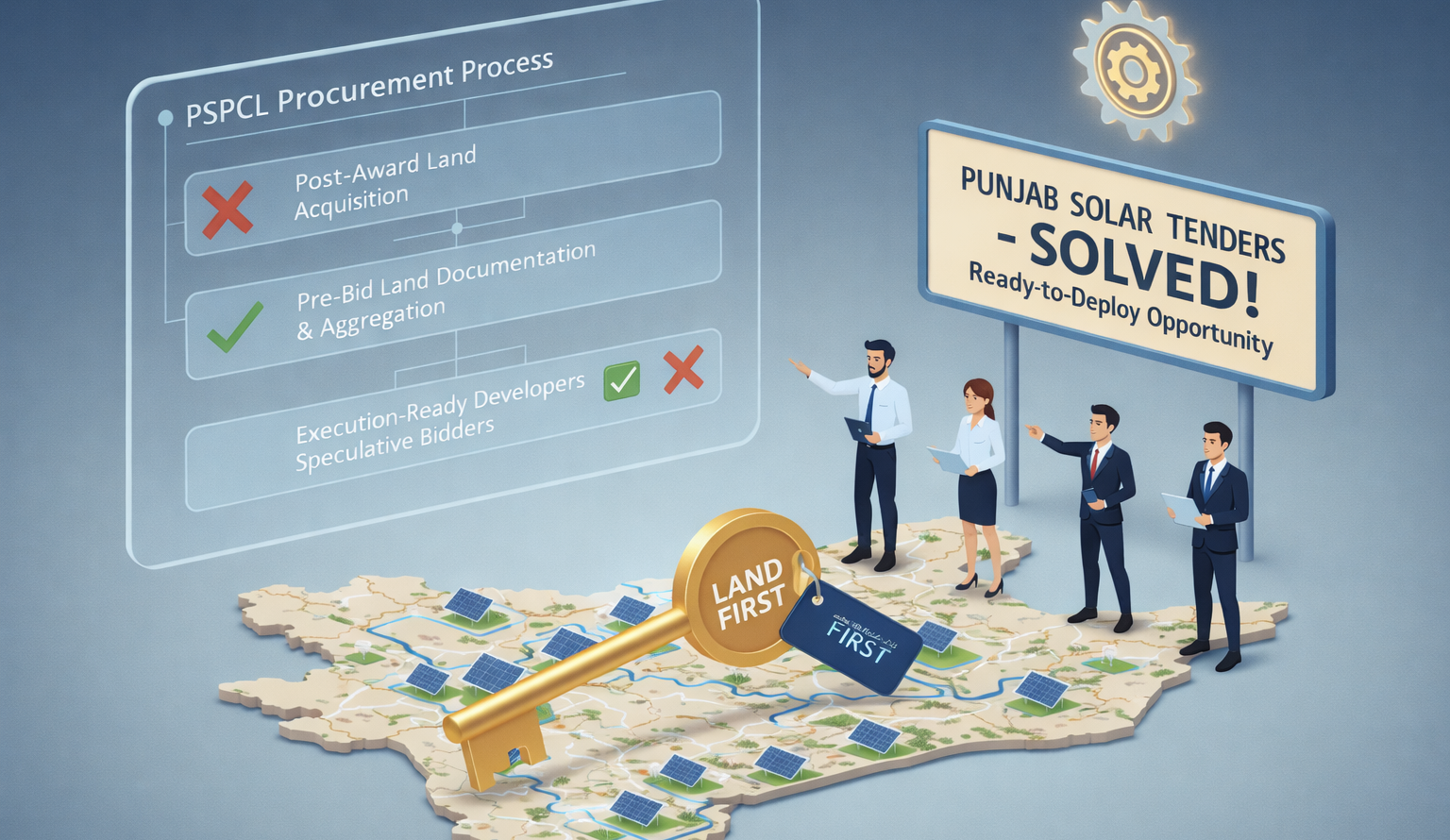

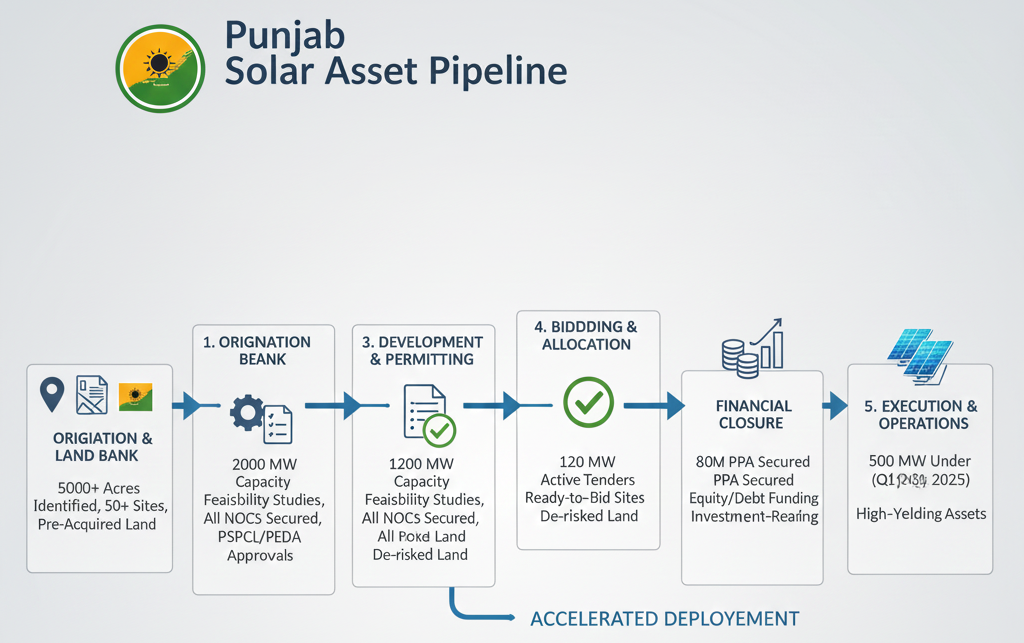

Punjab has entered a disciplined phase of utility-scale solar procurement—one that clearly separates execution-ready developers from speculative bidders.

Under the latest PSPCL solar projects, land is no longer a post-award activity or a negotiable variable. Project land must be fully identified, aggregated, and documented at the time of bidding—and cannot be changed after bid submission.

For institutional developers, infrastructure funds, and EPC majors, this single requirement has quietly become the largest execution and bid-qualification risk in Punjab.

We’ve already addressed it.

The New Reality of Punjab Solar Procurement

Punjab’s current tender framework reflects a clear policy intent:

only bidders with execution certainty should qualify.

As a result, the following land-related conditions now apply:

Project land must be identified and documented before bidding

No post-bid change in project location permitted

Entire land risk rests with the bidder

Land details form part of the technical qualification

This structure aligns PSPCL’s objectives with on-time commissioning, financial closure discipline, and grid planning certainty, while shifting execution responsibility decisively to the bidder.

Why Land Is the Real Challenge in Punjab — Even for Large Developers

Punjab is not land-scarce.

It is land-fragmented and administratively layered.

Utility-scale solar land typically involves:

- Multiple private landowners

- Complex revenue and mutation records

- Village-level social and access dynamics

- Time-intensive aggregation under local constraints

For large IPPs and funds, this translates into:

- Post-award execution risk

- Delays in financial closure

- Escalating land costs under bid timelines

- Inability to substitute or relocate sites

In a tender where land is frozen at bid stage, these risks directly threaten qualification, timelines, and IRR protection.

What We Have Already Executed on the Ground

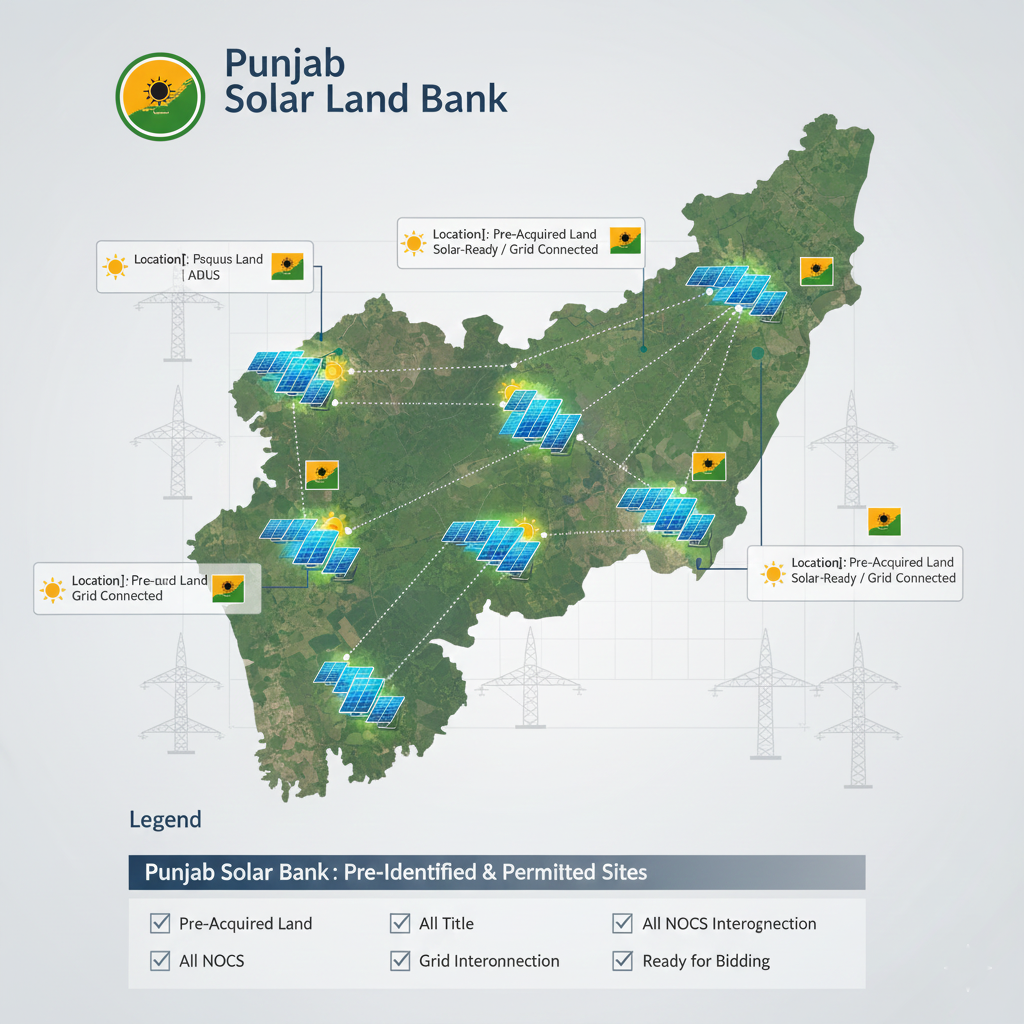

We have already pre-aggregated over 300 acres of solar-suitable land across multiple strategic locations in Punjab, structured specifically to align with the current and upcoming PSPCL utility-scale solar tenders.

This land has not been identified speculatively. Each site has been evaluated through the lens of tender compliance, execution feasibility, and long-term project bankability, ensuring it can move directly from bid submission to development without structural changes, relocations, or renegotiation risk.

Our land portfolio is:

Aggregated in 50 MW+ contiguous clusters, meeting minimum capacity thresholds under PSPCL tenders

Located in solar-viable, grid-aligned regions, with practical proximity to substations and evacuation infrastructure

Structured with assignable ownership or long-term lease frameworks, allowing seamless SPV transfer post-award

Tender-ready for direct inclusion in bid submissions, with land documentation aligned to technical qualification requirements

Vetted for on-ground execution feasibility, including access, layout flexibility, and minimal social or title-related disruption

In practical terms, this means the most time-consuming, execution-critical, and risk-exposed component of the Punjab solar tender process has already been addressed. Developers are not entering the bid with assumptions or placeholders, but with defined, auditable land positions that can withstand lender scrutiny, regulatory review, and post-award diligence, in line with expectations set by Ministry of New and Renewable Energy (MNRE) and state procurement authorities.

This significantly compresses development timelines, improves confidence during financial closure, and allows serious bidders to focus capital and management effort on tariff strategy, financing, and timely commissioning, rather than resolving land uncertainties under tender deadlines.

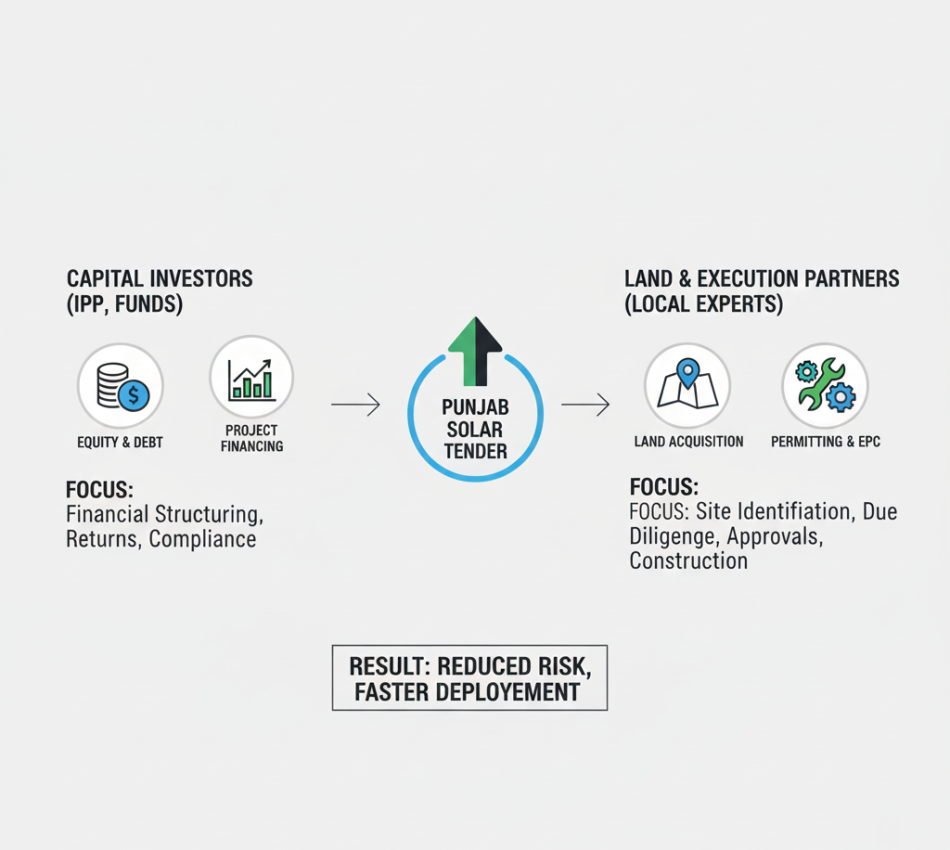

A Partnership Model Designed for Institutional Developers

We partner with financially strong IPPs, infrastructure and renewable energy funds, and EPC majors seeking exposure to Punjab utility-scale solar without absorbing local land aggregation, regulatory navigation, or execution risk.

The model is intentionally simple and institutionally aligned:

each party focuses strictly on its core strength, with no overlap, dilution of responsibility, or execution ambiguity—ensuring clear accountability, faster decision-making, and smoother post-award execution.

What Is Required From You

Financial strength — net worth, liquidity, and banking comfort in line with PSPCL qualification norms

Bid participation and tariff strategy, including disciplined reverse auction execution

SPV ownership and capital deployment, post-award and in line with agreed timelines

Lender relationships and financial closure, including documentation, approvals, and drawdown

No local land build-out, no on-ground aggregation effort, no administrative navigation, and no post-award land risk absorption. The partnership is structured so that capital providers and developers remain focused on scale, returns, and execution discipline, while land and local complexities are already resolved.

What We Manage on Your Behalf

We act as your local development and execution partner through Innocepts Solar Private Limited, managing every non-core, execution-sensitive risk layer that typically slows down or destabilizes utility-scale solar projects in Punjab.

Our role is to absorb the ground-level complexity—land aggregation, local coordination, regulatory navigation, and execution interfaces—so that your organization can remain focused on capital deployment, bidding discipline, and portfolio-scale outcomes, without being drawn into operational, administrative, or regional uncertainties.

Land Aggregation & Structuring

- Tender-compliant land documentation

- Site-wise MW planning

- Local validation and stakeholder coordination

Regulatory & Ground-Level Consultancy

- PSPCL tender alignment support

- Local administration coordination

- Pre- and post-bid execution assistance

EPC & Project Execution Support (Optional)

- EPC delivery or coordination

- Owner’s engineering and project management

- On-ground execution oversight

Why This Model Works for Serious Players

This structure is designed for large developers and institutional investors who prioritize execution certainty over theoretical scale.

It enables participants to:

Enter Punjab without building or managing local land teams, eliminating a major fixed-cost and coordination burden

Bid confidently in tenders where land is locked upfront, removing uncertainty at the technical qualification stage

Avoid post-award land surprises, which are among the most common causes of delay, cost overruns, and lender concern

Focus senior management bandwidth on scale, returns, and portfolio strategy, rather than site-level problem solving

Instead of spending months resolving land aggregation, documentation, and local coordination under tender deadlines, you begin with a defined, tender-ready project foundation. This allows faster decision-making, smoother financial closure, and a materially higher probability of on-time commissioning and IRR preservation.

Who This Opportunity Is Built For

This model is designed for organizations that approach utility-scale solar with a long-term, execution-focused mindset, rather than short-term or speculative bidding.

It is best suited for:

Independent Power Producers (IPPs) targeting state DISCOM PPAs who require land certainty, predictable timelines, and smooth progression from bid award to commissioning

Infrastructure and renewable energy funds seeking deployable, de-risked solar assets that can move efficiently into construction and financial closure

EPC majors aiming to convert awarded tenders into fully executable projects faster, without absorbing land aggregation or local execution complexity

If you are planning 50 MW to 300 MW of utility-scale solar capacity in Punjab, this approach is no longer optional. Under the current PSPCL tender framework, it has become a prerequisite for qualification, execution certainty, and on-time project delivery.

Punjab Solar Is Ready — If You Enter It Right

Punjab is not a difficult market.

It is a disciplined market—one that rewards preparation, execution certainty, and institutional seriousness.

Developers who enter with:

Locked and tender-compliant land

Local execution depth and on-ground readiness

Clear role separation between capital, development, and execution

Will win projects, achieve financial closure smoothly, and commission on time.

Those who don’t will struggle much earlier—often failing to clear technical qualification, regardless of tariff competitiveness or balance sheet strength.

Punjab does not penalize ambition.

It penalizes unprepared entry.

Let’s Explore a Structured Partnership

If you are evaluating Punjab solar tenders and are looking for:

Land already secured and tender-ready

Local execution managed end-to-end

Capital deployed without ground-level risk or delay

We should talk.

At Innocepts Solar, we work with serious IPPs, infrastructure funds, and EPC majors to enable execution-ready entry into Punjab’s utility-scale solar market, backed by locked land, local depth, and disciplined project structuring.

For developers and investors evaluating broader policy-linked risks beyond state tenders, we also share detailed insights on DISCOM credit risk under central schemes, including a focused analysis on DISCOM Credit Risk in KUSUM-A—covering payment security mechanisms, counterparty risk, and implications for project bankability.

Reach out to explore structured partnership opportunities for utility-scale solar projects in Punjab, built for developers who value certainty, speed, and long-term performance—and who take a disciplined view of both execution risk and offtake risk.

FAQ's

Punjab solar tenders require approximately 2.5 acres per MW, fully identified and documented at bid stage.

No. Project location and land cannot be changed after bid submission under current PSPCL tenders.

Because land is fragmented, involves multiple owners, and must be secured before bidding, making delays and disputes high-risk.

Yes, provided the lease is long-term, assignable, and tender-compliant.

The bid risks technical disqualification, regardless of tariff competitiveness.

The minimum project capacity is 50 MW, with cumulative limits per bidder.

The entire land risk lies with the bidder, not PSPCL.

Locked land significantly accelerates financial closure and lender confidence.

Yes. Punjab offers strong solar irradiation, stable DISCOM procurement, and long-term PPAs — if entered correctly.

By partnering on pre-aggregated, tender-ready land and focusing capital on bidding and execution.